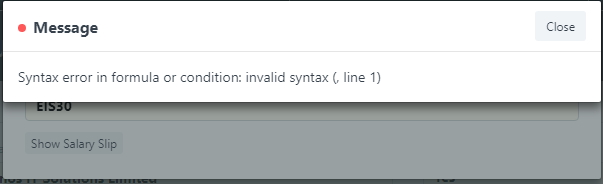

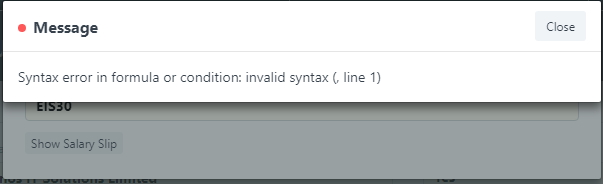

My Salary Structure keeps giving errors, even after checking through severally.

Kindly see below

My Salary Structure keeps giving errors, even after checking through severally.

Kindly see below

can you please share the complete earning and deduction table’s screenshot? Try standard conversion of first component (base) and then value. It should matter, but just for the sake it trial.

I think the error is in the formula syntax in the Basic Allowance in earnings. Try entering the formula as base * 0.12. this i believe will eliminate the formula syntax error. You may also want to ensure that all your formulas follow the format as indicate d in the examples.

@umair, Thank you for your response.

PS: I have rearranged the placement of the base variable, however, I do not think that can affect it as it is only a variable that acts as a value container.

I need to be sure if the ERPNext can handle sophisticated payroll calculations as this is a very good pointer too an area of improvement if not able.

I have rearranged the placement of the base variable, however, I do not think that can affect it as it is only a variable that acts as a value container.

Here are the list of the formuars used for the structure:

Component: Basic Allowance

Condition: Nill

Formular: base*.12

Component: Housing Allowance

Condition: Nill

Formular: base*.2

Component: Transportation Allowance

Condition: Nill

Formular: base*.15

Component: Other Allowances

Condition: Nill

Formular: base*.53

Component: CRA

Condition: base*.01>(200000DT/12)

Formular: base.01

Statistical

Component: CRA

Condition: base*.01<(200000DT/12)

Formular: (200000DT/12)+(base*.2)

Statistical

Component: Reimbursibles

Condition: Nill

Formular: base*.47

Component: NHF

Condition: Nill

Formular: BA*.025

Statistical

Component: Total

Condition: Nill

Formular: CRA+RE+EPCS+NHF

Statistical

Component: Taxable Income

Condition: Nill

Formular: base-TL

Statistical

Component: Employer’s Pension Contribution

Condition: Nill

Formular: 0.1*(BA+HA+TA)

Statistical

Component: NSITF

Condition: Nill

Formular: 0.01*(BA+HA+TA)

Statistical

Component: Employee’s Pension Contribution

Condition: Nill

Formular: 0.08*(BA+HA+TA)

Component: 1st Band

Condition: (300000DT/12)<TI

Formular: 300000DT/12*.07

Statistical

Component: 1st Band

Condition: (300000DT/12)>TI

Formular: TI.07

Statistical

Component: 2nd Band

Condition: 300000*DT/12>TI

Formular: 0

Statistical

Component: 2nd Band

Condition: 600000DT/12>TI

Formular: (TI-(300000DT/12))*.11

Statistical

Component: 2nd Band

Condition: 600000DT/12<TI

Formular: 300000DT/12*.11

Statistical

Component: 3rd Band

Condition: 600000*DT/12>TI

Formular: 0

Statistical

Component: 3rd Band

Condition: 1100000DT/12>TI

Formular: (TI-(600000DT/12))*.15

Statistical

Component: 3rd Band

Condition: 1100000DT/12<TI

Formular: 500000DT/12*.15

Statistical

Component: 4th Band

Condition: 1100000*DT/12>TI

Formular: 0

Statistical

Component: 4th Band

Condition: 1600000DT/12>TI

Formular: (TI-(1100000DT/12))*.19

Statistical

Component: 4th Band

Condition: 1600000DT/12<TI

Formular: 500000DT/12*.19

Statistical

Component: 5th Band

Condition: 1600000*DT/12>TI

Formular: 0

Statistical

Component: 5th Band

Condition: 3200000DT/12>TI

Formular: (TI-(1600000DT/12))*.21

Statistical

Component: 5th Band

Condition: 3200000DT/12<TI

Formular: 1600000DT/12*.21

Statistical

Component: 6th Band

Condition: (3200000*DT/12)>TI

Formular: 0

Statistical

Component: 6th Band

Condition: (3200000DT/12)<TI

Formular: (TI-((3200000DT/12)))*.24))

Statistical

Component: PAYE (Tax Exposure)

Condition: (1BD+2BD+3BD+4BD+5BD+6BD)<.01base

Formular: .01base

Component: PAYE (Tax Exposure)

Condition: (1BD+2BD+3BD+4BD+5BD+6BD)>.01*base

Formular: 1BD+2BD+3BD+4BD+5BD+6BD

Component: Total Deductions

Condition: Nill

Formular: EPCS+PAYE+IOU+LR+LF

Statistical

Component: IOU

Condition:

Formular:

Component: Loan Repayment

Condition:

Formular:

Component: Lateness Fine

Condition:

Formular:

Sr Name Abbr Type

1 Employee’s Pension Contribution EPCS Deduction

2 Duration DT Earning

3 NSITF NSITF Deduction

4 Total Deductions TD Deduction

5 6th Band 6BD Deduction

6 5th Band 5BD Deduction

7 4th Band 4BD Deduction

8 3rd Band 3BD Deduction

9 2nd Band 2BD Deduction

10 1st Band 1BD Deduction

11 Total TL Earning

12 IOU IOU Deduction

13 Refund To Staff RTS Earning

14 Bonus BN Earning

15 Lateness Fine LF Deduction

16 Loan Repayment LR Deduction

17 Taxable Income TI Earning

18 PAYE (Tax Exposure) PAYE Deduction

19 NHF NHF Earning

20 Reimbursibles RE Earning

21 CRA CRA Earning

22 Employer’s Pension Contribution EPC Deduction

23 Other Allowances OT Earning

24 Transportation Allowance TA Earning

25 Housing Allowance HA Earning

26 Basic Allowance BA Earning

27 Leave Encashment LE Earning

28 Arrear A Earning

29 Income Tax IT Deduction

From what i see you’re trying to use the standard formula for calculating PAYE deductions. I tried to do so much earlier but ERPNext doesn’t as yet support complex formula as excel does from what i was told. So you’re better off using actual figures for PAYE deductions or determine the actual percentage if you wish to use formula:

My life has been easy ever since. Maybe when the formula code is upgraded to allow for excel-like conditions we may be able to enter PAYE calculations this way but for now we just have to make do with what we have.

It is possible to enter PAYE calculations. I have implemented it.

Here is a sample of my PAYE deductions from Tanzania

Would you be kind as to show the full salary structure so i can understand your calculations better?

Your calculations seem simple enough to understand but i think mine is a little more complex than this so it might be difficult to adapt it. I would have loved to attach a sample PAYE calculator in excel for you to see the calculations and underlying formula because at first glance it seems yours is similar to ours but there might be slight differences in the way graduated tax is implemented based on the formula. However, this forum does not allow files to be attached. But here’s the screenshot of the calculator:

Here are the formula for each step:

1st 300,000 - =IF(PAYE!$D$22>300000,300000,D22)

NEXT 300,000 =IF(PAYE!$D$22-SUM(PAYE!I32)>300000,300000,PAYE!D22-SUM(PAYE!I32))

NEXT 500,000 - =IF(PAYE!$D$22-SUM(PAYE!I32:I33)>500000,500000,PAYE!D22-SUM(PAYE!I32:I33))

NEXT 500,000 - =IF(PAYE!$D$22-SUM(PAYE!I32:I34)>500000,500000,PAYE!D22-SUM(PAYE!I32:I34))

NEXT 1,600,000 - =IF(PAYE!$D$22-SUM(PAYE!I32:I35)>1600000,1600000,PAYE!D22-SUM(PAYE!I32:I35))

NEXT 3,200,000 - =IF(PAYE!$D$22-300000>=3200000,D22-3200000,PAYE!$D$22-SUM(I32:I36))

I’m not too sure i can be able to adapt the above formula to ERPNext as you have and i’m sure a lot of us would be keenly interested in being able to implement a proper formula-based PAYE calculation on ERPNext. So if you can use the above data to do a demo salary structure it will be an awesome breakthrough for those of us who use ERPNext here and have relied on manual calculations for tax.

I think it is possible. But I can’t quite understand your formulas.

I also see cells I32, I33, I34, I35. What is in column I? In order to assist you with this I need to understand the formulas first